When it comes to financial success—either personal or professional—budgeting is the cornerstone. Whether you’re a homeowner, freelancer, business owner, or facility manager, the right budgeting software can save you time, reduce stress, and help you make smarter decisions. In 2025, budgeting tools have become more powerful, more automated, and more tailored to different needs.

But what is the best software for budgeting? The answer depends on your goals. Some tools are built for individuals and families; others focus on small business operations or enterprise asset tracking. If you’re a facilities or operations manager, you’ll want software that blends budgeting with asset oversight and maintenance scheduling.

Let’s explore the top choices for budgeting software in 2025, starting with a hidden gem that’s ideal for facilities professionals.

1. FacilityBot – Best Budgeting Software for Facilities and Operations Management

Best for: Facility managers, property teams, operations heads

If you’re managing buildings, campuses, or distributed facilities, FacilityBot should be your first pick. While it’s primarily known as a facility management system, it includes powerful tools for budgeting, cost tracking, and expense management.

Key Features:

- Integrated Budget Control: Track costs across maintenance, repairs, and asset replacements in one platform.

- Procurement Insights: Tie expenses to procurement workflows and automate financial approvals.

- Preventive Maintenance Costs: Forecast future spend based on maintenance schedules and asset conditions.

- Vendor Budget Tracking: Monitor spend per vendor or contractor and align with budget thresholds.

- Mobile Accessibility: Submit, approve, and monitor expenses from anywhere.

Why It Stands Out:

FacilityBot bridges the gap between operations and finance. By combining maintenance requests, asset tracking, and vendor management with budgeting tools, you gain full visibility over where your money is going—and where you can cut costs. For businesses and institutions, this is far more effective than standalone budgeting software.

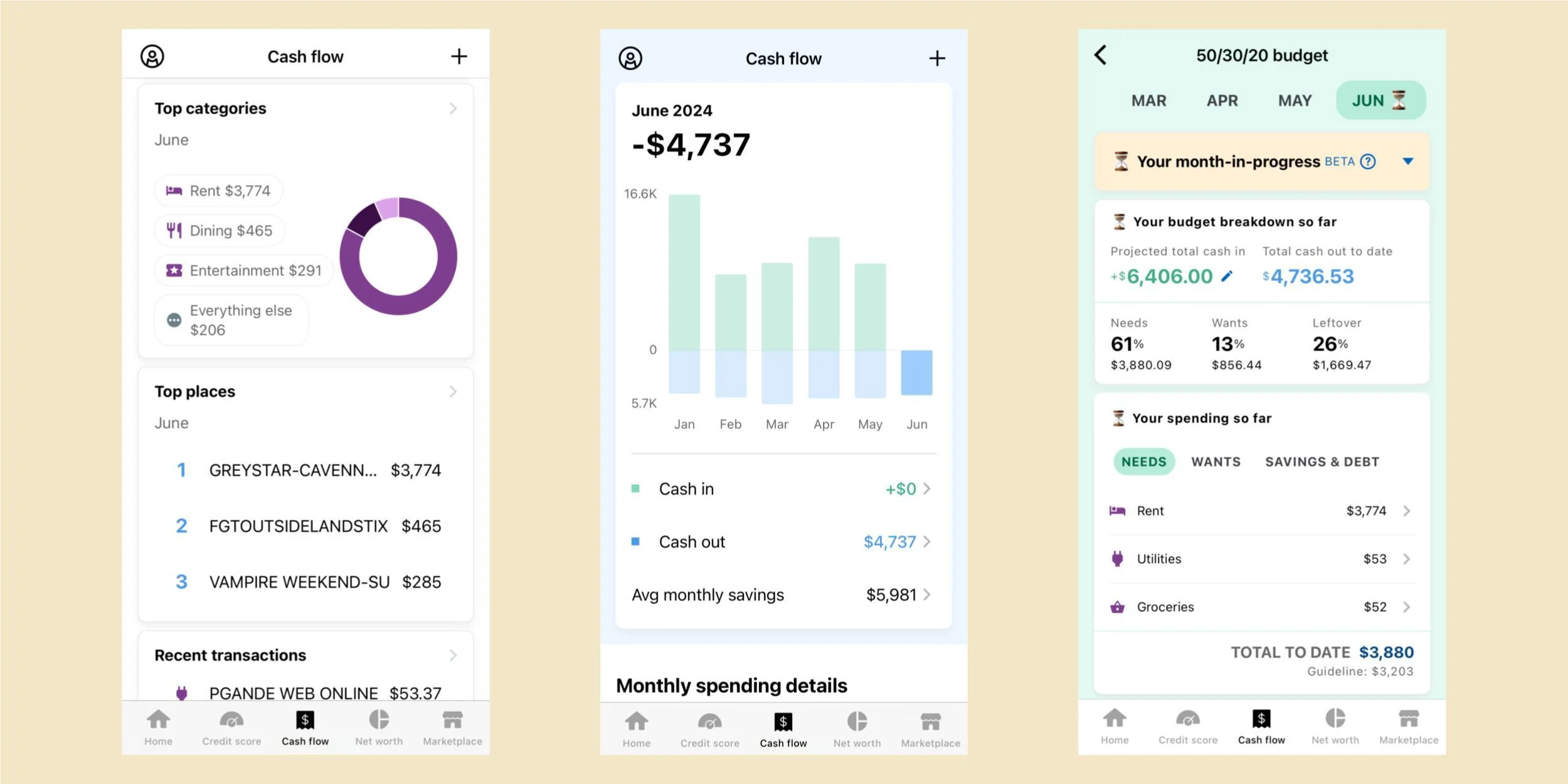

2. Simplifi by Quicken – Best Overall Personal Budgeting App

Best for: Everyday users seeking balance and clarity

Simplifi offers an intuitive dashboard that makes it easy to monitor your finances at a glance. It’s especially great for people who want a modern interface without the learning curve.

Highlights:

- Set savings goals and spending limits

- Categorize transactions automatically

- Connect all accounts in one view

- Real-time updates across devices

If you’re looking for a mobile-friendly, fast, and modern budgeting app that delivers solid financial insights, Simplifi is an excellent choice.

3. YNAB (You Need a Budget) – Best for Behavioral Change

Best for: People struggling to manage money and break poor habits

Price: $14.99/month or $99/year

YNAB is built around zero-based budgeting. It encourages users to give every dollar a job and teaches financial mindfulness through goal setting and strategy.

Key Benefits:

- Educational videos and live workshops

- Debt paydown tools

- Real-time collaboration for households

- Syncs bank accounts and credit cards

It’s especially valuable for people trying to get out of debt or save for a big goal, like a wedding, home, or vacation.

4. Quicken Classic – Best for Financial Power Users

Best for: Detail-oriented users who want legacy-style desktop tools

Price: Starts at $2.99/month

Quicken Classic is the most robust option for those who want to analyze trends, prepare for taxes, and manage investments alongside budgeting.

Notable Features:

- Custom reports and tax summaries

- Investment performance tracking

- Bill pay features and check printing

- Secure cloud backup

While not as sleek as some newer apps, Quicken Classic’s features make it worth it for advanced users.

5. NerdWallet – Best Free Budgeting and Credit Monitoring App

Best for: Beginners and users who want a free, no-frills tool

Price: Free

NerdWallet connects to your financial accounts and gives you a clean, ad-free interface to track your spending and credit health.

Perks:

- Credit score and net worth tracking

- Simple financial summaries

- Articles and how-tos for better financial literacy

If you’re just getting started or want to keep things super simple, NerdWallet is the way to go.

6. Rocket Money – Best for Managing Subscriptions and Reducing Waste

Best for: People who want to eliminate hidden expenses

Price: Free tier available; Premium from $48/year

Previously known as Truebill, Rocket Money helps you uncover subscriptions, track expenses, and even cancel unwanted charges automatically.

Key Features:

- Budgeting and bill negotiation

- Subscription cancelation assistance

- Credit report and net worth insights

Rocket Money is ideal for users overwhelmed by monthly recurring charges who want quick wins in their budgeting process.

7. Monarch Money – Best for Freelancers and Families

Best for: Users managing irregular income or shared budgets

Price: Premium tier only

Monarch provides an aesthetically pleasing experience, along with solid financial features geared toward modern users who want both individual and shared budgeting power.

Why It’s Useful:

- Link unlimited accounts

- Collaborate with partners or spouses

- Set goals by category (home, travel, retirement)

If you’re managing a small business, side hustle, or shared household finances, Monarch offers powerful customization.

8. PocketGuard – Best for Budget Simplicity

Best for: People who want to budget without thinking too hard

Price: Free and premium versions available

PocketGuard simplifies budgeting by showing you how much money you have left after bills, subscriptions, and savings goals.

Features:

- Smart spending insights

- Automatic categorization

- “In My Pocket” real-time safe spending amount

It’s great for users who want hands-off budgeting that just works.

9. Credit Karma – Best for Credit Tracking with Budget Insights

Best for: Users focused on improving credit and financial health

Price: Free

Credit Karma provides a user-friendly portal to monitor your credit scores and offers budgeting help by giving spending breakdowns and personalized suggestions.

What Sets It Apart:

- No-cost credit reports from TransUnion and Equifax

- Alerts for credit changes and fraud

- Tips to improve your credit profile

While not a traditional budget app, it’s invaluable for long-term financial success.

10. Empower (formerly Personal Capital) – Best for Investment-Based Budgeting

Best for: Long-term planners, retirees, and investors

Price: Free basic plan, advisory services at premium tier

Empower focuses on growing your net worth through smart investing and budgeting. While it’s not built for daily expenses, it’s great for seeing your big-picture financial health.

Key Advantages:

- Retirement and net worth tracking

- 401(k) fee analyzer

- Investment allocation and performance tools

- Goal-based planning

If you’re already saving and investing, Empower offers a professional-level dashboard to stay on top of your financial future.

Specialty Budgeting Tools for Specific Needs

- Greenlight – Best for teaching kids about money

- Monarch – Ideal for self-employed professionals

- PocketGuard – Perfect for users overwhelmed by financial management

- Credit Karma – Best for monitoring credit score

- Empower – Best for investors and retirement planning

What Can Budgeting Software Actually Do?

If you’re asking, “What is the best software for budgeting?”, it’s important to know what these apps can offer:

- Account Aggregation: See all your accounts, balances, and transactions in one place.

- Budget Creation & Tracking: Set limits, monitor categories, and adjust as needed.

- Goal Setting: Plan for emergencies, travel, or big purchases.

- Credit Monitoring: Some apps like Credit Karma and NerdWallet help you track and improve your credit score.

- Bill Management: Receive due date reminders and monitor payments.

- Investment Tracking: Some premium tools include detailed asset management features.

Are Budgeting Apps Safe?

Yes—most budgeting software uses bank-level encryption and secure authentication protocols. Services like Quicken, YNAB, and NerdWallet often partner with Plaid or similar platforms to establish secure connections with your financial institutions. For optimal safety:

- Use unique, strong passwords and a password manager

- Enable multi-factor authentication (MFA)

- Avoid sharing personal data unnecessarily

How to Choose the Right Budgeting Software

Here are a few key questions to ask yourself:

- Do you want a personal, business, or hybrid solution?

For facilities management and operational cost tracking, FacilityBot is unmatched. - Are you focused on behavior change or simple tracking?

Choose YNAB for financial discipline, or Simplifi for clean simplicity. - Need advanced reporting and tax tools?

Go with Quicken Classic or Empower. - Want to track shared finances?

Try Monarch or PocketGuard. - Prefer something free and educational?

NerdWallet or Credit Karma are solid options.

Final Verdict: What is the Best Software for Budgeting in 2025?

It all comes down to your priorities. If you’re in facility management, FacilityBot delivers a comprehensive facility management system with budgeting baked in—something generic budgeting apps can’t offer.

For individuals and families, Simplifi, YNAB, and Monarch offer excellent, intuitive features depending on your needs. Investors and detail lovers will appreciate Empower and Quicken, while budget-conscious users will find value in Rocket Money and NerdWallet.

Start by assessing your financial habits and needs, then match them to the software that gives you the most clarity, control, and convenience.